When it comes to finding the best auto insurance deal, avoiding hidden fees is crucial. This guide will walk you through the essential steps to secure the most affordable quote without any surprises along the way.

As we delve into the world of auto insurance, you'll discover valuable insights and tips to navigate the process with ease.

Researching Auto Insurance Providers

When looking for the cheapest auto insurance quote without hidden fees, it is crucial to research different auto insurance providers to find the best coverage options. Here are some steps you can take to make an informed decision:

List of Reputable Auto Insurance Companies

- Geico

- Progressive

- State Farm

- Allstate

- USAA

These are some of the well-known and reputable auto insurance companies that you can consider for your coverage needs.

Compare Coverage Options

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

It is important to compare the coverage options offered by different providers to ensure you are getting the best value for your money.

Checking Customer Reviews and Ratings

- Look for customer reviews and ratings on websites like J.D. Power and Consumer Reports.

- Check the Better Business Bureau for any complaints against the insurance companies.

- Ask for recommendations from friends and family who have had positive experiences with their auto insurance providers.

By checking customer reviews and ratings, you can get a better idea of the quality of service provided by each company and make an informed decision.

Factors Affecting Auto Insurance Quotes

When it comes to determining auto insurance quotes, several factors come into play, influencing the final cost. Understanding these factors can help you navigate the process more effectively and potentially save money on your premiums.

Personal Factors Impacting Insurance Quotes

- Your age: Younger drivers typically face higher insurance premiums due to their lack of experience on the road.

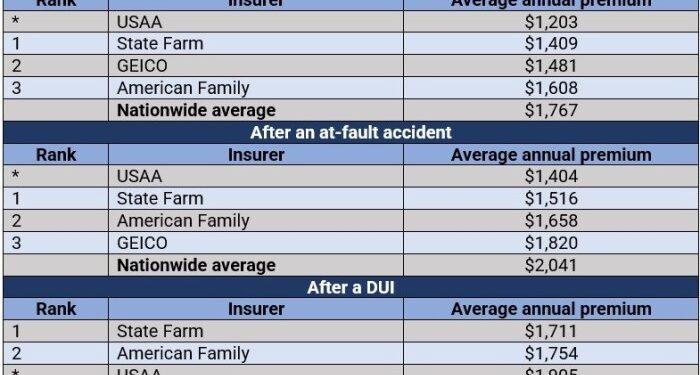

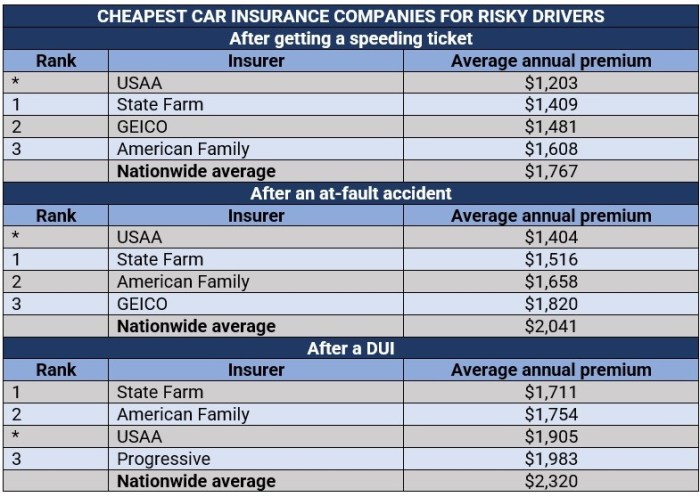

- Driving record: A clean driving record with no accidents or traffic violations can lead to lower insurance costs, while a history of accidents or tickets can result in higher premiums.

- Location: Where you live can also affect your insurance rates, with urban areas often experiencing higher premiums than rural areas due to factors like traffic density and crime rates.

Vehicle Type and Safety Features

- The type of vehicle you drive plays a significant role in determining insurance costs. Generally, sports cars and luxury vehicles have higher premiums due to their increased risk of theft and costly repairs.

- Safety features such as anti-theft devices, airbags, and advanced driver assistance systems can help lower insurance premiums by reducing the likelihood of accidents and theft.

Deductibles and Coverage Limits

- The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your premiums, but it also means you'll have to pay more in case of an accident.

- Coverage limits determine the maximum amount your insurance company will pay for a claim. Higher coverage limits typically result in higher premiums, but they offer more protection in case of a severe accident.

Understanding Hidden Fees in Auto Insurance

When it comes to auto insurance, hidden fees can often catch policyholders off guard, resulting in unexpected expenses. It is crucial to have a clear understanding of what hidden fees are and how to identify them to avoid any surprises.

Examples of Common Hidden Fees

- Processing fees for policy changes or updates

- Administrative fees for issuing documents or certificates

- Cancellation fees if you decide to switch insurance providers

- Underwriting fees for assessing risk and determining premiums

- Late payment fees for missing payment deadlines

Reading the Fine Print in Insurance Policies

One of the best ways to uncover hidden fees in auto insurance is by carefully reading the fine print in insurance policies. Pay close attention to any additional charges or fees that may not be clearly Artikeld in the policy summary.

Understanding the terms and conditions of your insurance coverage can help you identify and avoid hidden fees that could impact your overall costs.

Tips for Getting the Cheapest Quote

When looking to get the cheapest auto insurance quote, there are several strategies you can employ to help lower your costs. By taking advantage of discounts, maintaining a good credit score, and adjusting your coverage options, you can potentially save money on your premiums.

Bundling Insurance Policies for Discounts

One effective way to lower your auto insurance costs is by bundling your policies. Many insurance companies offer discounts to customers who purchase multiple policies, such as auto and home insurance, from the same provider. By bundling your policies, you can often save money on both premiums, making it a cost-effective option for many individuals.

Maintaining a Good Credit Score

Your credit score can have a significant impact on your auto insurance premiums. Insurance companies often use credit scores as a factor in determining rates, with lower credit scores typically resulting in higher premiums. By maintaining a good credit score, you can potentially qualify for lower rates and save money on your auto insurance.

Raising Deductibles to Reduce Premiums

Another strategy to consider when trying to get the cheapest auto insurance quote is to raise your deductibles. By increasing the amount you are willing to pay out of pocket in the event of a claim, you can lower your premiums.

While raising your deductibles can save you money on your premiums, it's important to ensure you can afford the higher out-of-pocket costs before making this adjustment.

Last Point

In conclusion, by following the strategies Artikeld in this guide, you can confidently seek out the cheapest auto insurance quote without falling prey to hidden fees. Stay informed, compare your options, and drive with peace of mind knowing you've got the best deal possible.

FAQ Explained

What factors can influence auto insurance quotes?

Factors such as age, driving record, location, type of vehicle, safety features, deductibles, and coverage limits all play a role in determining insurance costs.

How can maintaining a good credit score help lower insurance costs?

Insurance companies often consider credit scores when calculating premiums. A good credit score can demonstrate financial responsibility and may lead to lower insurance costs.

What are hidden fees in auto insurance policies?

Hidden fees in auto insurance are additional charges that are not explicitly stated in the policy. These can include processing fees, policy fees, or other hidden charges.