Embark on a journey through the world of trip insurance comparison in 2025, exploring the nuances of different policies and uncovering the best coverage options available.

Delve into the realm of trip insurance to discover the ideal policy that suits your travel needs and provides peace of mind during your adventures.

Overview of Trip Insurance Comparison 2025

When planning a trip, one crucial aspect to consider is trip insurance. With various policies available in the market, it is essential to compare them to ensure you choose the best coverage for your needs. Comparing trip insurance policies can help you make an informed decision and select the right plan that offers adequate protection during your travels.

Importance of Comparing Trip Insurance Policies

Comparing trip insurance policies allows you to evaluate different coverage options, benefits, and costs offered by various insurance providers. It helps you understand the extent of protection each policy offers and identify any exclusions or limitations that may impact your trip.

By comparing policies, you can find the most suitable coverage that aligns with your travel plans and budget.

Key Factors to Consider When Comparing Policies

- Coverage Limits: Evaluate the maximum coverage amount provided by each policy for medical expenses, trip cancellations, baggage loss, and other potential risks.

- Policy Exclusions: Pay attention to exclusions such as pre-existing medical conditions, high-risk activities, or specific destinations not covered by the policy.

- Emergency Assistance Services: Check if the policy includes 24/7 emergency assistance services for medical emergencies, travel disruptions, or other urgent situations.

- Cost and Value: Compare the premiums of different policies against the coverage benefits to determine the overall value offered by each plan.

Significance of Choosing the Right Coverage for a Trip

Choosing the right coverage for your trip is crucial to safeguard yourself against unforeseen events that may disrupt your travel plans. Adequate trip insurance can provide financial protection in case of trip cancellations, medical emergencies, lost baggage, or other unexpected incidents during your journey.

By selecting the appropriate coverage, you can travel with peace of mind and mitigate potential risks that could otherwise result in financial losses or inconvenience.

Types of Trip Insurance Policies

When it comes to trip insurance, there are various types of policies available in 2025 to cater to different travel needs. Two common options are single-trip insurance and annual multi-trip insurance, each offering distinct benefits and coverage levels to travelers.

Single-Trip Insurance

Single-trip insurance is designed to provide coverage for a specific trip, whether it's a weekend getaway or a long vacation. This type of policy typically includes benefits such as trip cancellation, trip interruption, emergency medical coverage, and baggage loss or delay protection.

Single-trip insurance is ideal for travelers who take occasional trips throughout the year and want comprehensive coverage for each individual journey.

Annual Multi-Trip Insurance

On the other hand, annual multi-trip insurance is suitable for frequent travelers who embark on multiple trips within a year. This type of policy offers coverage for an unlimited number of trips during the policy period, usually spanning 12 months.

Annual multi-trip insurance provides similar benefits as single-trip insurance, but with the convenience of not having to purchase a new policy for each trip. It is cost-effective for those who travel regularly and want continuous coverage throughout the year.Overall, the choice between single-trip insurance and annual multi-trip insurance depends on the frequency of your travels and the level of coverage you require.

Whether you opt for single-trip insurance for specific journeys or annual multi-trip insurance for continuous protection, both types of policies offer peace of mind and financial security during your travels.

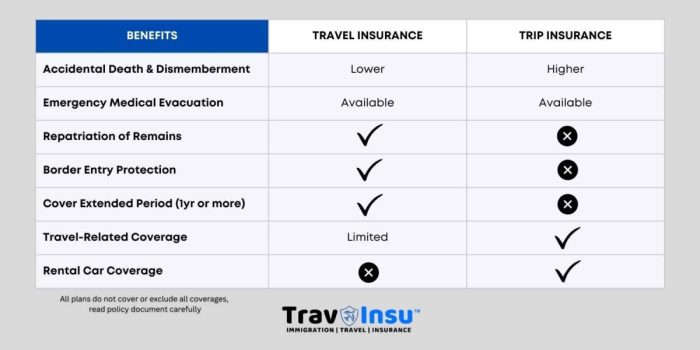

Coverage Comparison

When comparing trip insurance policies, it is crucial to understand the coverage options each one offers. Let's take a closer look at the differences in coverage for trip cancellation, medical emergencies, travel delays, and more.

Trip Cancellation Coverage

- Policy A: Provides coverage for trip cancellation due to unforeseen circumstances such as illness or natural disasters.

- Policy B: Offers trip cancellation coverage for a wider range of reasons, including job loss or terrorist attacks.

- Policy C: Has strict criteria for trip cancellation coverage and may not cover certain pre-existing conditions.

Medical Emergencies Coverage

- Policy A: Covers emergency medical expenses during the trip, including hospital stays and medical evacuation.

- Policy B: Offers higher coverage limits for medical emergencies and may include coverage for emergency dental treatment.

- Policy C: Limits coverage for medical emergencies and may require upfront payments for services.

Travel Delays Coverage

- Policy A: Provides compensation for travel delays, such as accommodation and meal expenses, due to airline strikes or severe weather.

- Policy B: Offers coverage for missed connections and additional expenses incurred during travel delays.

- Policy C: Has strict limits on reimbursement for travel delays and may exclude coverage for delays caused by airline overbooking.

It is essential to carefully review the policy coverage limits and exclusions to ensure you have the protection you need during your trip.

Cost Analysis

When it comes to trip insurance policies, the cost of premiums is calculated based on various factors such as the traveler's age, trip duration, destination, coverage limits, and any additional options selected.

Factors Affecting Premiums

- The traveler's age: Younger travelers typically pay lower premiums compared to older travelers due to lower risk factors.

- Trip duration: Longer trips may result in higher premiums as there is an increased likelihood of trip interruptions or cancellations.

- Destination: Traveling to certain high-risk destinations may lead to higher premiums due to increased medical or travel risks.

- Coverage limits: Policies with higher coverage limits for medical expenses, trip cancellations, or baggage loss will generally have higher premiums.

- Additional options: Adding on coverage for adventurous activities, pre-existing medical conditions, or rental car protection will impact the overall cost of the policy.

Comparison of Pricing Models

Insurance companies offering trip insurance may have different pricing models based on their underwriting practices and risk assessments. Some companies may offer flat rate premiums based on predetermined factors, while others may calculate premiums individually based on the traveler's specific risk profile.

Technology Trends in Trip Insurance

In 2025, technology is revolutionizing the trip insurance industry, offering new possibilities and enhancing the overall customer experience.

Role of AI, Machine Learning, and Data Analytics

AI, machine learning, and data analytics are playing a crucial role in shaping trip insurance policies. These technologies are being used to analyze vast amounts of data quickly and accurately, leading to more personalized and efficient coverage options for travelers.

- AI algorithms can assess risk factors and predict potential issues before they occur, allowing insurance companies to offer proactive solutions to travelers.

- Machine learning models are being used to improve fraud detection and streamline claims processing, making the entire insurance process faster and more reliable.

- Data analytics help insurers understand customer behavior and preferences, enabling them to tailor policies that meet individual needs effectively.

Improving Customer Experience

Technology is transforming the way customers interact with trip insurance, making it easier and more convenient to purchase and manage policies.

Mobile apps and online platforms are providing travelers with instant access to insurance information, allowing them to make informed decisions on-the-go.

- Chatbots powered by AI are offering real-time assistance to customers, answering queries and guiding them through the insurance buying process efficiently.

- Automated claim processes using machine learning algorithms are reducing paperwork and simplifying the claims experience, leading to faster reimbursements for travelers.

- Personalized recommendations based on data analytics are helping travelers choose the most suitable coverage options, ensuring they have the right protection for their specific needs.

Last Point

In conclusion, navigating the landscape of trip insurance comparison in 2025 is crucial for ensuring a worry-free travel experience. Choose wisely and embark on your next trip with confidence knowing you have the best coverage at your disposal.

General Inquiries

What are the key factors to consider when comparing trip insurance policies?

When comparing trip insurance policies, it's essential to look at coverage limits, exclusions, premiums, and benefits to determine which policy offers the best value for your needs.

How are premiums calculated for trip insurance policies?

Premiums for trip insurance policies are calculated based on various factors such as trip cost, traveler's age, destination, duration of travel, and the level of coverage chosen.

What technology trends are shaping trip insurance in 2025?

In 2025, technology such as AI, machine learning, and data analytics are transforming trip insurance by enhancing policy customization, claims processing efficiency, and overall customer experience.